WHAT DOES IT MEAN FOR ME?

In a slightly delayed Autumn budget, Jeremy Hunt has made an array of announcements that have largely left us feeling both better off and worse off all at once. Whilst the rates of tax have remained the same or as previously agreed through announcements made by Rishi Sunak’s predecessor, it is the annual allowances for various taxes that have changed and is what will affect us all.

Importantly, this means that seeking a strong long-term financial plan is even more critical and we will continue to work with you to make sure you are ready to face this new tax regime.

INCOME TAX

Rates - Income tax rates for 2023/24 will remain at the basic, higher and additional rates of 20%, 40% and 45% respectively. The abolition of the additional rate of tax announced in the Mini Budget will not happen.

The Scottish Government intend to hold their own Budget on 15th December, and this will determine the rates which will apply to Scottish taxpayers.Allowances and thresholds - the point at which additional rate tax becomes payable will be cut from £150,000 to £125,140 from 6 April 2023. The Government forecast that approximately 250,000 individuals will pay some extra tax due to this measure.

The personal allowance and basic rate band remain frozen at £12,570 and £37,700 respectively. This freeze of allowances has been extended by a further two years until April 2028. This means that the higher rate tax threshold will remain at £50,270 (for those entitled to a full personal allowance).

Dividends - The dividend allowance is to be halved from £2,000 to £1,000 for 2023/24 and halved again to £500 for 2024/25. Consequently, many more investors will need to complete tax returns if their dividend income exceeds £1,000 next year. The dividend tax rates for basic rate, higher rate and additional rate taxpayers will remain at 8.75%, 33.75% and 39.35% for both the current tax year and 2023/24. The 1.25% increase installed from the start of 2022/23 will not be reversed.

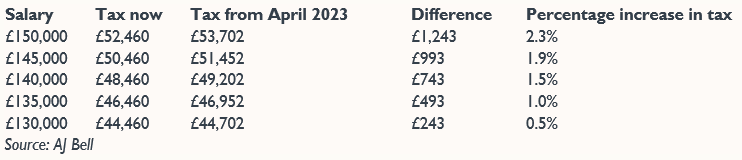

Income tax for the additional rate taxpayer this means that higher rate earners who now fall within this hole will pay an extra income tax as shown below.

Dividend tax will have a limited affect on your investments with McLaren as it will not have any impact on ISAs, however, a General Investment Account (GIA) can receive dividends which will need declaring on your self-assessment, if they exceed the allowance. The change in the dividend allowance will largely affect you if you draw dividends from your business or any other income source. In the first year you could be liable to an extra £87.50, £337.50 or £393.50 for basic, higher and additional rate taxpayers respectively. By year two and the second allowance reduction this would increase to £131.25, £506.25 and £590.25 respectively per annum.

PENSIONS

There were no changes announced to pension tax relief. Wage inflation may also mean that a pension contribution is a more attractive option for those who may otherwise lose out on child benefit or personal allowance.

It was also confirmed that the triple lock on the State Pension would be maintained along with the same level of increase to the Pension Credit.

There has been an ongoing review of State Pension age and whether the current timetable for changes is still appropriate. The Government will publish their response in early 2023.

There was no mention of any extension to the freeze to the lifetime allowance which is expected to remain fixed at £1,073,100 until April 2026.

Those people who are soon to be classified as additional rate income taxpayers will now qualify for 45% pension tax relief, meaning 5% more tax relief than previously. Planning can help can get those taxes back from the government and put them into your pension.

This also means that if you are in receipt of the state pension, the Treasury have honoured the triple lock and you are due to receive a 10.1% rise in 4-weekly payments effective April 2023.

NATIONAL INSURANCE

The 1.25% increase to NI to help pay for social care reforms has been scrapped; it was added to the rates of NI for 2022/23 for employees, employers and the self-employed, being removed from November 2022.

NI thresholds will be fixed at the current 2022/23 levels. The changes to the thresholds at which individuals (both employed and self-employed) start to pay NI, which were introduced in July 2022, will remain - i.e. they're kept in line with the annual personal allowance of £12,570.

This means that someone earning £50,000 a year would be saving £505 on national insurance contributions and the Treasury claims this could save the average business £10,000 in employer national insurance contributions over the next year.

CAPITAL GAINS TAX

The chancellor announced that the CGT annual exemption would be cut from £12,300 to £6,000 from April 2023, and to £3,000 from April 2024. Based on 2021/22 figures an estimated extra 235,000 individuals will need to file a self-assessment return in 2023/24 as consequence.

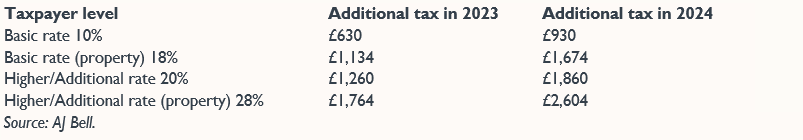

There was no change to the rates of CGT as detailed in the table below.

The cut to the capital gains tax (CGT) annual allowance is the biggest change that will affect your investments. It will become a lot harder to remain within the annual CGT allowance each year when the allowance is halved then halved again. Assuming you will have capital gains higher than the current CGT allowance of £12,300, the extra tax due would be as follows:

Planning can help use any remaining allowance this tax year and use of any losses should also be considered.

INHERITANCE TAX

The freeze on both the nil rate band (NRB) and residence nil rate band (RNRB) has been extended for an additional two years to 2028.

The nil-rate band for inheritance tax remains frozen at £325,000 with an extra residential nil-rate band of £175,000 for homeowners where their net estate is valued below £2,000,000. The rate of inheritance tax above these bands is 40% unless you gift 10% of your estate to charity, then it reduces to 36%.

Planning ahead, including lifetime gifts plus use of trusts and IHT exempt assets, should be considered.

CORPORATION TAX

Corporation tax will rise to 25% from 1st April 2023 for most businesses.

For the business owners amongst us, this means that all businesses with profits above £50,000 will be paying an additional 6% corporation tax, totalling 25%. Tapering relief has been reintroduced for those whose profits sit between £50,000 and £250,000. If you have profits below £50,000 you will continue to pay the current 19%.

STAMP DUTY

The Stamp Duty cuts for property purchases whereby no tax is paid on the first £250,000 (£450,000 for first time buyers), now have an end date in 2025, reducing back down to £125,000 (£300,000 for first time buyers). Although, the property sector is now predicting that house prices will decline over the next 18 months, people will then start to panic that they want to save tax before the stamp duty tax cut deadline in 2025 and as such more houses will be thrown on the market and prices will increase again.

Importantly, claiming either higher or additional rate tax relief for your pensions requires a claim through self-assessment, as does the payment of CGT. Accountants may well be celebrating.

Past performance is not a guarantee of future performance, investments can go down as well as up, all information is correct as of 21st November 2022.

If you are concerned about what this means for your personal tax liability and your future plans, why don’t you contact one our independent financial advisers for a consultation, on us.