OUR REVIEW OF KEY EVENTS DURING THE LAST MONTH

21/11/2022

McLaren Portfolios

November was a better month for McLaren portfolios as all strategies delivered a positive return spurred on by a Rishi Sunak relief rally and a calming of the interest rate outlook. The key highlights are:

The positioning in healthcare equity continued to deliver positive returns.

Equity assets in general saw some rebound from poorer returns earlier this year.

Short-dated bond funds avoided most of the sell off seen in the bond market.

Infrastructure assets which had been doing well were hit by the big sell off in Gilt markets but have already started to recover now markets have calmed down.

Whilst it has been a challenge to make and keep any positive returns this year it has been reassuring that the strategy and diversification has meant that we are performing resiliently.

Global Financial News

Developed markets had a rather mixed but positive month, reacting to mainly economic news and data.

The anticipated fall in US inflation data led to some relief but the Federal Reserve will want to rely on a trend of data to be confident it is curtailing inflation. Whilst markets rebounded during the beginning of November this does seem somewhat premature. Bond markets began to factor in a slowing of interest rate hikes and yields pulled back.

The continued war in Ukraine and the pressure on key commodity supplies remained especially with gas. Despite this the EU has successfully been buying up marginal supply at elevated prices. A moderate season so far has meant the EU has been able to ramp up storage reserves to high levels, access a wider source of supply, and to take a range of demand management actions, which has meant a log jam in unloading LNG (Liquidified Natural Gas) at European ports is now materialising. All of these has increased the probability for Europe to survive a cold winter without any significant Russian gas supply.

The continuing woes in Asia, especially China, where the zero-Covid tolerance program is curtailing economic recovery has meant that Asian equity markets have remained weak as a slower China, commodity, food, and fuel inflation, and unsettling politics continued to weigh down on this region.

Major western markets saw a bit of a relief rally and some recovery of the poorer returns experienced over the last year, with European markets leading the charge. This may continue if the US Fed signals a slowing in the pace of interest rate slows, but this is likely to run out of momentum and a re-focus on economic slowdown, interest rates, and supply shortages will pervade.

Housing markets, lower quality loans and leveraged assets faltered as the increasing cost of capital will cause these sectors to come under increased stress. Housing in US and UK markets has already seen a some pull back in deal volume, as well as increased delinquency and foreclosure rates.

Domestic News

The FTSE100 and especially the UK bond market had a tumultuous time as the focus on a change in government and then the shock of a poorly crafted and unfunded budget unsettled the market and led to a big selloff in Gilts. This weakened the pound and long-term Gilt yields rose to where the Bank of England had to intervene.

The FTSE100 continued to make a positive return over the month despite political uncertainties held up by energy, banks, and foreign earnings. Company reporting has been in line with expectations and whilst profits reduction has appeared many companies are still in good shape.

The swift and subsequent change of government, the third this year, has started to settle markets down as a more measured economic and budgetary outlook is being formulated, and a chaste and more cohesive edifice is presented to the public.

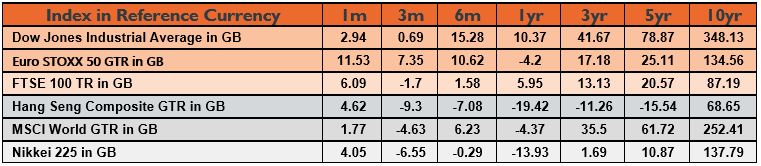

Market Data

Looking Forward

As before we think the rest of the year will continue to be dominated by two key factors - Gas and inflation.

Gas – as we have discussed the race is on for Europe to avoid a deep recession and wean itself off Russian gas. Outside a cold winter it looks like the EU has done enough to survive without a major shutdown of industrial production, avoiding an even deeper recession.

Inflation/interest rates – the downturn in recent US inflation data has given markets some relief, however the US Fed is unlikely to pause its interest rate hiking phase until real evidence of an economic slowdown and the curtailing of inflation can be demonstrated. US Federal Reserve policy is likely to dominate global monetary policy for some while as a weakened Europe and China/Asia overcome regional issues and local inflation. The impact on consumers and producers will continued to be felt, and the likelihood of a recession in 2023 looks feasible.

And finally

Whilst market pricing has been volatile and poor, the underlying assets held within McLaren portfolios are much more realistically priced and dividends can be maintained for now. Bond assets have also seen yields improve substantially, and whilst we expect interest rates to go up further, we believe that inherent returns from bonds will continue to improve.

We believe 2023 is the year that the headwinds of Covid lockdowns, energy security, and interest rates will be allayed, and financial assets will resume on the long road to recovery out of any recession.